Visualizing the Social Software and Collaboration Marketplace

How can we best understand the broad social software and collaboration vendor marketplace?

I'd just been pondering that question when Dion Hinchcliffe published a nifty little graphic.

Source: Dion Hinchcliffe - Click to enlarge |

There's a lot to like about this chart: it's comprehensive and makes a nice division between content management and social computing vendors. Unfortunately, the chart does not tell a prospective buyer some important details, like what the products actually do, the size of the vendors, and what it's like to work with those vendors or tools.

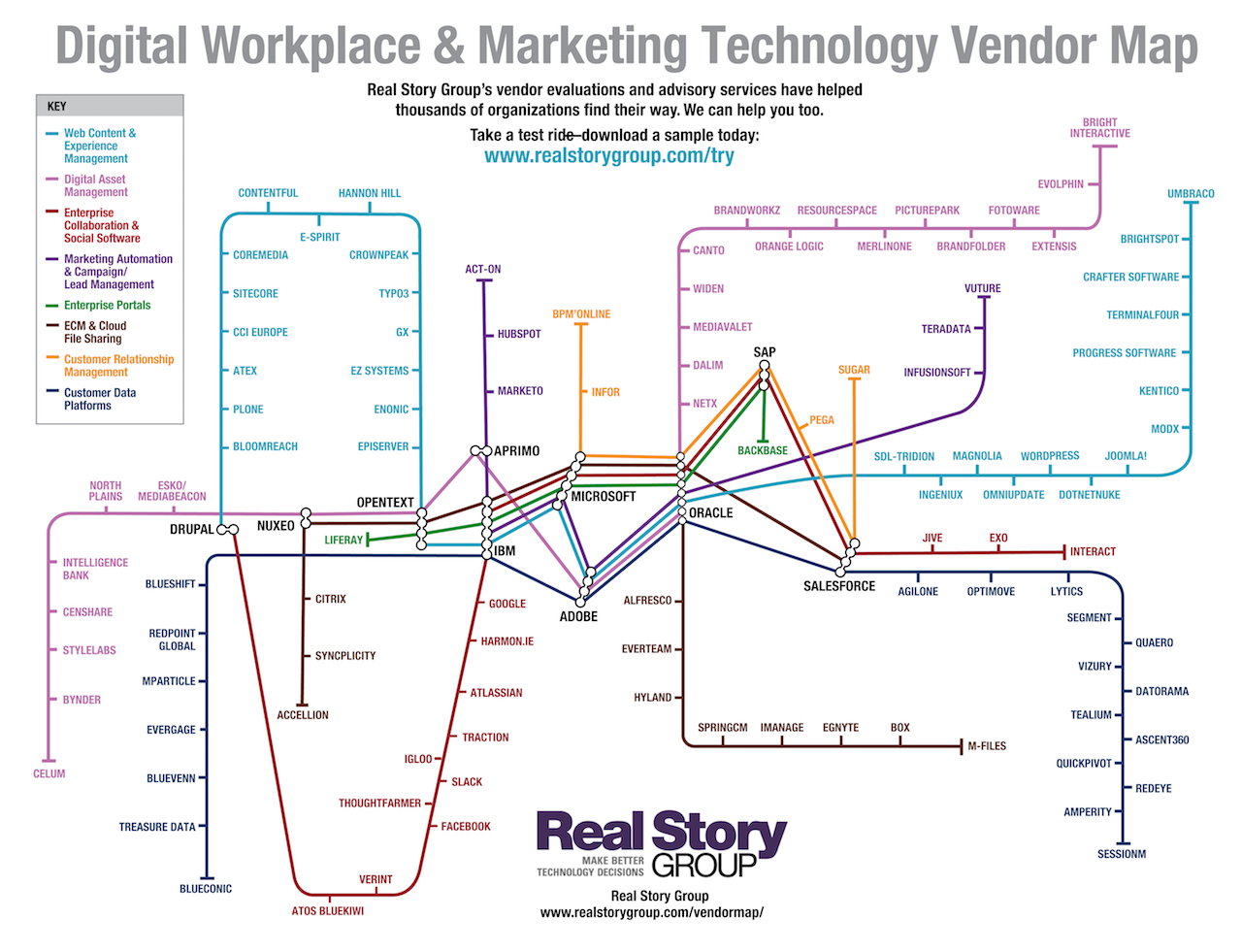

Here's our simple division of the enterprise social software and collaboration marketplace, into six categories. I don't claim that this is a complete list of vendors -- just a categorization of the most important ones on enterprise buyers' short lists today. It also does not confer any "leadership" status; a magic sextant this is not. But it does tell you where a vendor resides on the landscape.

Click to enlarge |

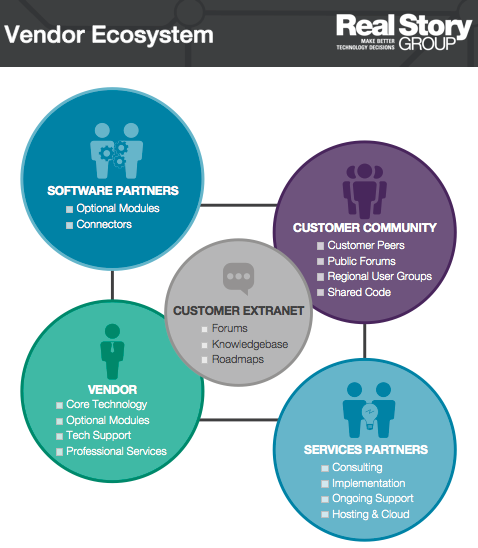

For a deeper look at what's happening in the marketplace, we turn to a different type of chart, a "Cross-Check."

Click to enlarge |

This chart shows the intersection of product and vendor evolution, so that prospective buyers can make risk/reward judgments. It really struck us after completing this exercise how much the broader social software and collaboration marketplace has become almost placid. Contrast this with some other Cross-Checks we've released recently, e.g., ECM or Portals. I think for enterprise customers -- especially social computing technology buyers -- placid is good. For a longer explanation of the chart, check out today's release about it, or view the brief slidecast on SlideShare

In the end, there's no perfect way to visualize such a complex marketplace, although I hope these three charts begin to point you in the right direction. There's also no substitute for getting the real story on any solution before you make an enterprisewide commitment. Our evaluation research could save you time and money. Drafting a solid RFP certainly helps. And then, as always, be sure to test before you decide.