Is Oracle the Next IBM for MarTech?

It’s been five years since IBM discharged its Marketing Technology portfolio in two fell swoops. After acquiring or building more than two-dozen marketing-related products, Big Blue decided to return to its server-management roots.

At the time, rival Oracle had a more modern and coherent MarTech story, but in the intervening years, Oracle’s portfolio in these markets has gotten quite long in the tooth. After hearing from a couple of disgruntled licensees in the past week, it got me thinking: how long will Oracle hold out in this space?

A Similar Trajectory

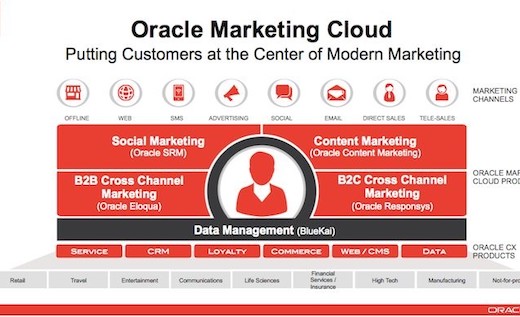

Oracle followed IBM’s strategy rather closely, albeit a bit later, and with generally more contemporary toolsets. Starting around 2010, Oracle departed from an earlier strategy that emphasized dependencies on their vaunted database and intead acquired a slew of independent vendors across the MarTech spectrum. Oracle began with multiple Web CMS platforms, then moved on to a DMP, a social marketing service, two email marketing platforms, and then various test, personalization, and ad management tools. None shared a common technology base.

Historically, Oracle was a solid acquirer of other tools, typically boosting security and reliability, while localizing interfaces across dozens of languages. At RSG we got the sense that this time was different: the MarTech platforms were pretty much left alone to subsist – with uneven product management – under an overall Oracle logo, amid various portfolio reorganizations.

Fast-forward to the early 2020s and Oracle has built its own CDP and a quasi-DAM from scratch, but otherwise just invested enough to keep the other tools alive. They sit among a broader constellation of products labeled “Advertising and Customer Experience (CX).” You’ll find heavier weight and deployment numbers among the sales platforms in this group, and it feels like the marketing platforms endure because Oracle feels like they should sell them, rather than they want to sell them.

Oracle's "Marketing Cloud" looks like a cohesive whole, but is really just a random collection of mostly aging tools. Image source: the vendor.

Marketing automation platform Eloqua is arguably the jewel of the suite. It has gone from super-extensible B2B enabler for large enterprises to a somewhat cranky, debt-ridden calliope, one that most licensees want to get off. (RSG evaluates Eloqua against multiple competitors in our Email & Marketing Automation stream; get a free sample here.)

What Next?

As non-strategic assets, the future of Oracle’s MarTech portfolio seems clouded in doubt. But what will happen?

Honestly your guess is as good as mine. The investor-juiced employee buy-out that converted multiple IBM platforms to a new home under “Acoustic” seems unlikely. A more promising suitor might be found in an HCL-type systems integrator looking to sop up ever-beloved maintenance and services revenue from aging but sticky platforms.

Of course a player like OpenText that makes a business by re-homing other zombie platforms could also step into the mix.

What Should You Do?

If you license an Oracle marketing platform, you should think about a replacement strategy now while you still have some control over timing. I wouldn’t counsel a rush to the exits, but do consider crafting a business case and requirements for a more modern MarTech stack. If you’re curious how RSG could help you, reach out for a no-obligation consultation.