Oracle acquires ATG

Last week, Oracle announced its acquisition of Art Technology Group (ATG) for $ 1 Billion. At this price, it might appear smaller than other, better-known acquisitions such as those of Sun Microsystems ($ 7.4 B), BEA Systems ($ 8.5 B), and PeopleSoft ($ 10.5 B in 2004), yet it's an important acquisition, nevertheless.

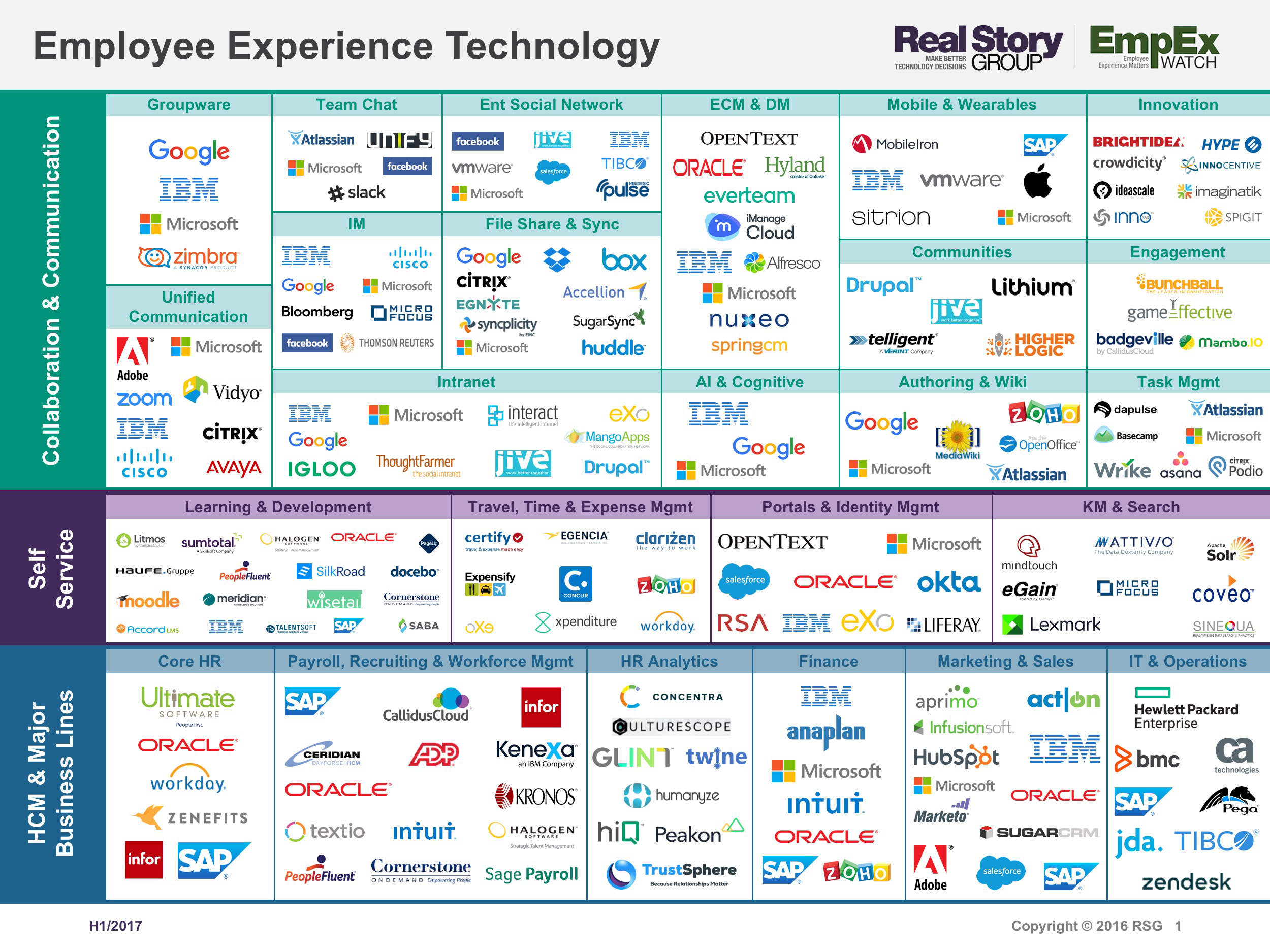

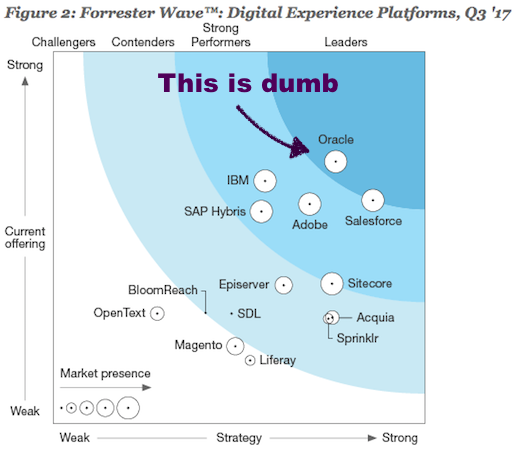

Oracle has a play in almost all the aspects of Enterprise Software: Portals, ECM, ERP, CRM, SCM, Middleware, and Retail. However, e-commerce is one area where it has gaps. Known for its commerce offerings, ATG will nominally plug those gaps and allow Oracle to compete more actively with IBM, who has IBM Commerce and Sterling Commerce offerings for e-commerce. From a nobody in e-commerce, Oracle will now suddenly become a "Leader" in analyst reports.

While ATG is known for its Commerce Suite and targets e-commerce scenarios exclusively, it also has many other components in the platform. For example, it has a pretty decent personalization engine, content management capabilities, features for self service / contact centers, analytics, and many other capabilities. These capabilities can actually make it a suitable Portal platform for many scenarios. In fact, many of its existing customers use ATG as a horizontal portal and we ourselves used to cover ATG in our Portals and Content Integration research until a few years back.

What this means is that, just like with most other acquisitions, there will be huge overlaps with Oracle's existing offerings. You would be forgiven for losing count of the number of Portal-type offerings Oracle now owns, and this will just add to that. It's not yet clear if Oracle will make ATG a part of Fusion Middleware, another component in the WebCenter Suite, or some other group within Oracle. Oracle acquired BEA in 2008 and Stellent in 2006 and those integrations are not really what I would call seamless. Similarly, it will not be trivial to integrate ATG with other Oracle offerings.

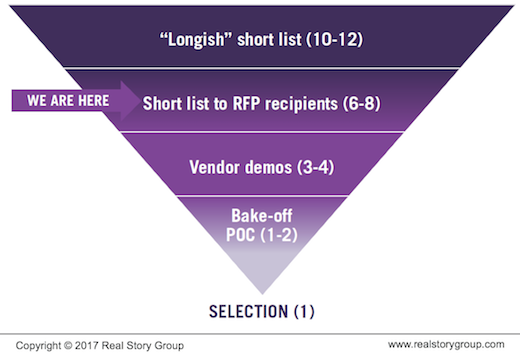

However, within those constraints, it is probably a good news for most customers. For ATG's existing customers who had been anxious about the company's financial performance, this news will be comforting. For others, there's no change in the near term other than the fact that they'll have a more stable e-commerce vendor to include on their short lists.