Enterprise Social-Collaboration - A Changing Landscape

At RSG, we define a digital workplace as the digital systems that employees use to get work done. That's a broad definition, but in practice, any knowledge-centric organizations needs to excel at enterprise social-collaboration. However, new research suggests a broadly changing landscape for this technology.

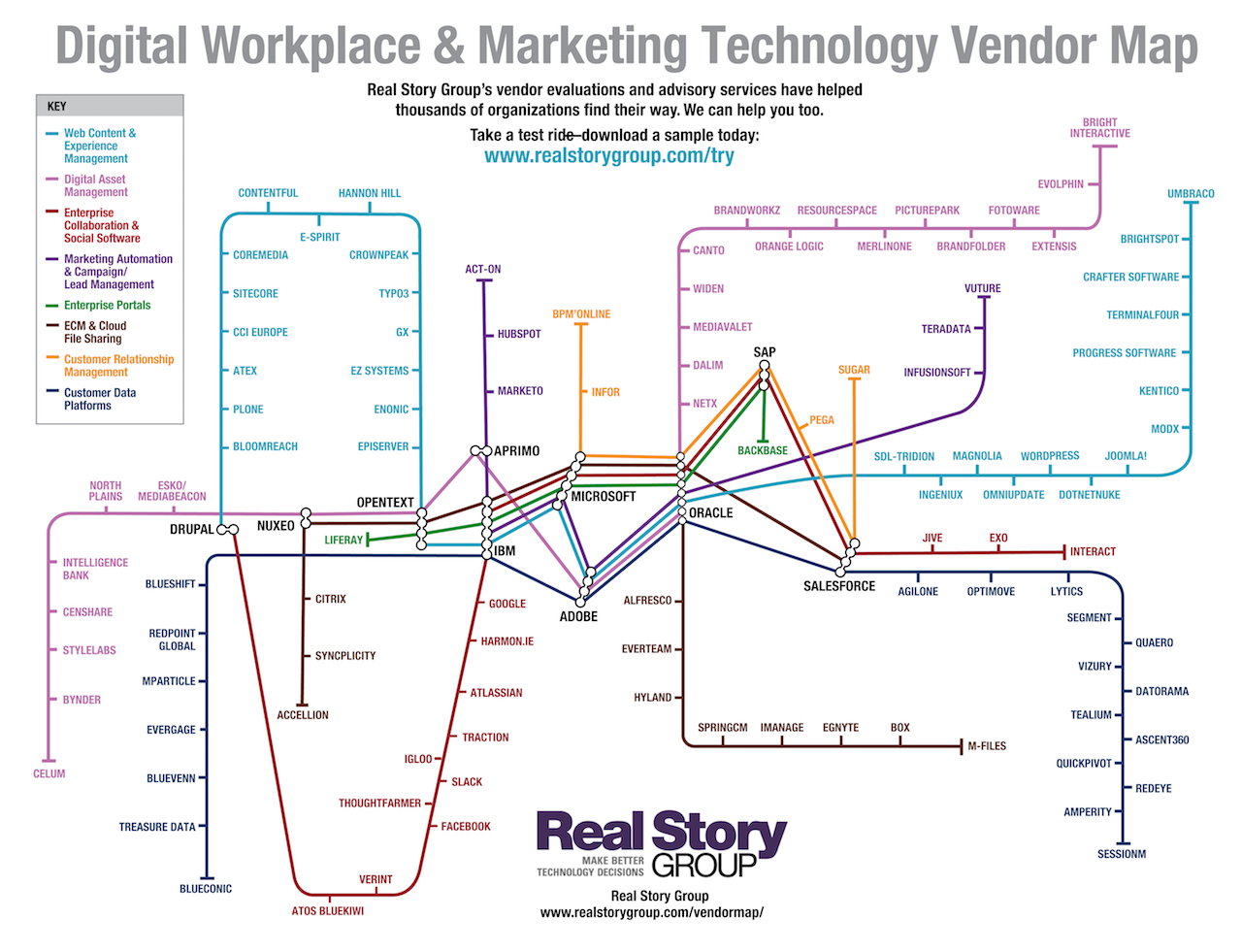

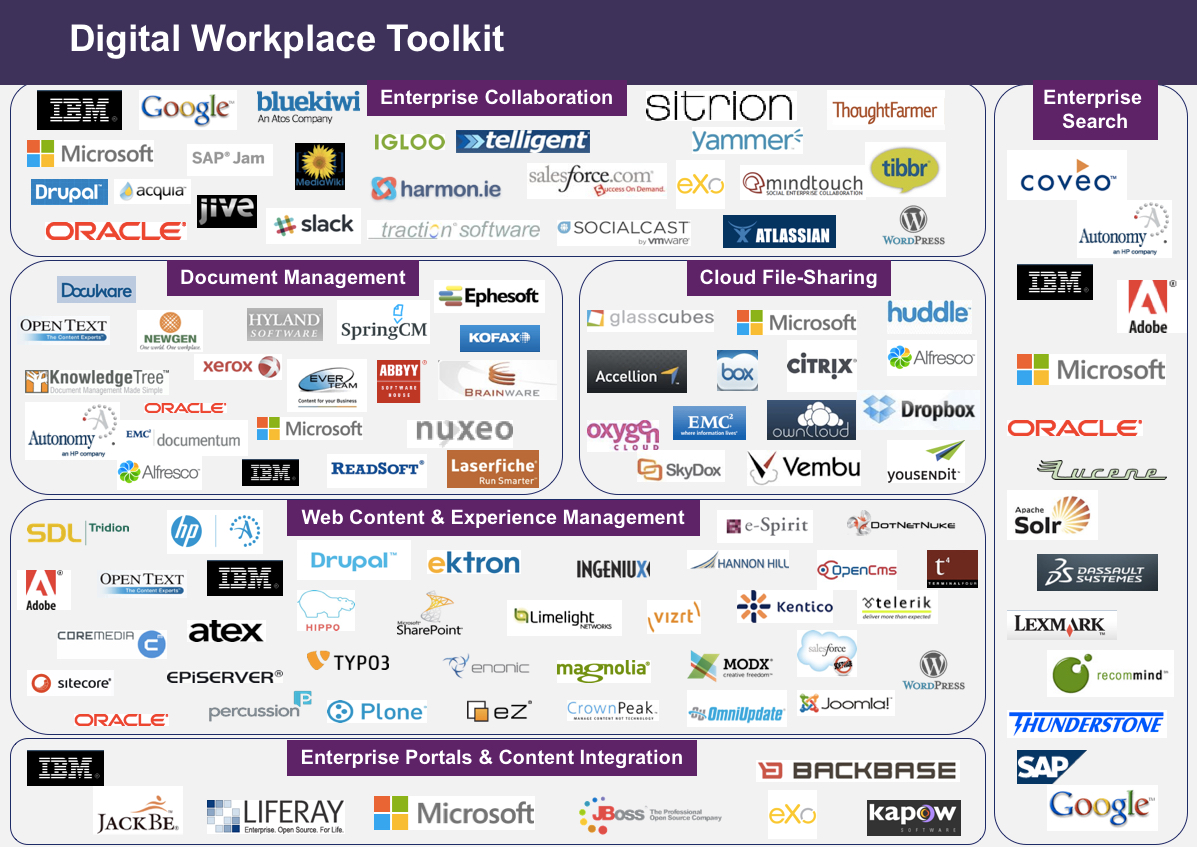

To be sure, several adjacent technologies become relevant depending on your context and industry. Indeed, RSG evaluates 50+ vendors across multiple digital workplace categories.

Figure 1: RSG Digital Workplace Toolkit.

But effective social-collaboration becomes table stakes for a truly employee-centric digital workplace. RSG recently released a major update to the vendor evaluations in our Enterprise Collaboration and Social Software research stream. Our discussions with customers and vendors and analysis of collaboration projects across industries revealed some interesting currents of change. Let's do a short tour.

Employee expectations of digital tools are higher than ever

- Employees expect tools to bring consumer-grade usability

- They want to use collaboration tools without a lot of training

- They expect tools to support their preferred ways of working, whether asynchronous (via messaging) or real-time (via chat / IM) or open interactions (e.g. social networking) — all in the context of their flow of work

- They want tools be fully mobile-enabled and available on-the-go

- They want tools smart enough to get better with usage

As a result, at RSG we've substantially toughened our evaluation criteria and expectations for what these tools deliver.

Enterprise approaches to collaboration programs are evolving

- Enterprises are beginning to acknowledge the importance of the employee (digital) experience

- They are evaluating collaboration projects with a cloud-first mindset, even if they initially deploy on-premise or hybrid alternatives.

- Customers seek short implementation cycles, which in turn increasingly favors SaaS-based alternatives

- Enterprises now prefer applications that deliver/demonstrate clear immediate business value or solve a specific problem for a specific group of employees

In response, we've updated RSG's list of use case criteria for contrasting vendor capabilities.

Vendors are scrambling to distinguish their offerings

- In the past few years several vendors have exited or retreated from this market, or pivoted or narrowed their focus, while of course new players have entered the market

- With the possible exception of SharePoint, few vendors can boast meaningful marketshare

- Larger vendors remain challenged to provide ready-to-use applications rather than foundational building blocks that require major interventions

- The difficult transition to Office 365/SP Online has exposed chinks in Microsoft's armor

- So this has become a long-tail market with several vendors known primarily in their home markets, or niche specialists focused on limited use cases

In our research we continue to cover smaller, niche players and social-layer vendors who are increasingly finding traction among enterprise customers.

What does this mean for your collaboration technology choices?

- As new collaboration use cases emerge, a single platform/product will not adequately address them, so savvy enterprise customers will plan to complement the capabilities of their main collaboration hub

- Newer and nimbler vendors will provide faster innovation, but this may come at the cost of administrative, compliance, and security functionality

What you should do...

There are no slam-dunk choices here, but a couple key take-aways:

- Make sure you assess your current effectiveness to uncover capacity gaps and benchmark against peers

- Explore technologies that can laser-target your top-priority use cases

Still have questions? Ping us for answers.