MarTech Mergers - Decoding the Aprimo Acquisition of ADAM Software

Aprimo, one of the vendors that we evaluate in our Campaign and Lead Management Technology Report, has acquired Digital Asset Management vendor ADAM, a vendor reviewed in our Digital and Marketing Asset Management Report.

What to make of this acquisition?

First let me bring you up to speed on Aprimo and its somewhat tortuous recent history. Circa 2010, Aprimo was a leading player in the Marketing Operations / Marketing Resource Management segment — at a time when large enterprise vendors such as IBM, Oracle, and Salesforce were busy acquiring marketing technology vendors.

Not to be outdone, data warehousing vendor Teradata acquired Aprimo and embarked on a quest to cobble together a broader marketing platform. Acquisitions of eCircle (email marketing), Argyle Social, FLXone (data management platform) and Appoxee (mobile marketing) followed soon.

But Teradata struggled to find traction in the MarTech segment and in 2016, after concluding that marketing applications were not a core business, it sold off this portfolio at a fraction of their purchase price to a private equity company called Marlin. Meanwhile, much technical debt has accumulated as the pace of product development suffered.

New owners Marlin also acquired a channel marketing technology vendor called Revenew and installed the Revenew CEO (a Teradata alum) as the CEO of Aprimo. Teradata spent years trying to rebrand Aprimo as Teradata and now Aprimo has gone back to its old moniker. BTW, Revenew is now called Aprimo Distributed Marketing. Is your head spinning yet?

Let me summarize:

- Teradata plowed hundreds of millions of dollars to put together a marketing platform but failed

- Marlin picked up the pieces at a discount

- Aprimo branding has been revived and a veteran executive is tasked with Making Aprimo Great Again

In all of this, the once-leading product has stagnated. For instance, more than 300 product enhancements have been identified by the company as part of a customer-listening tour.

Enter ADAM Software

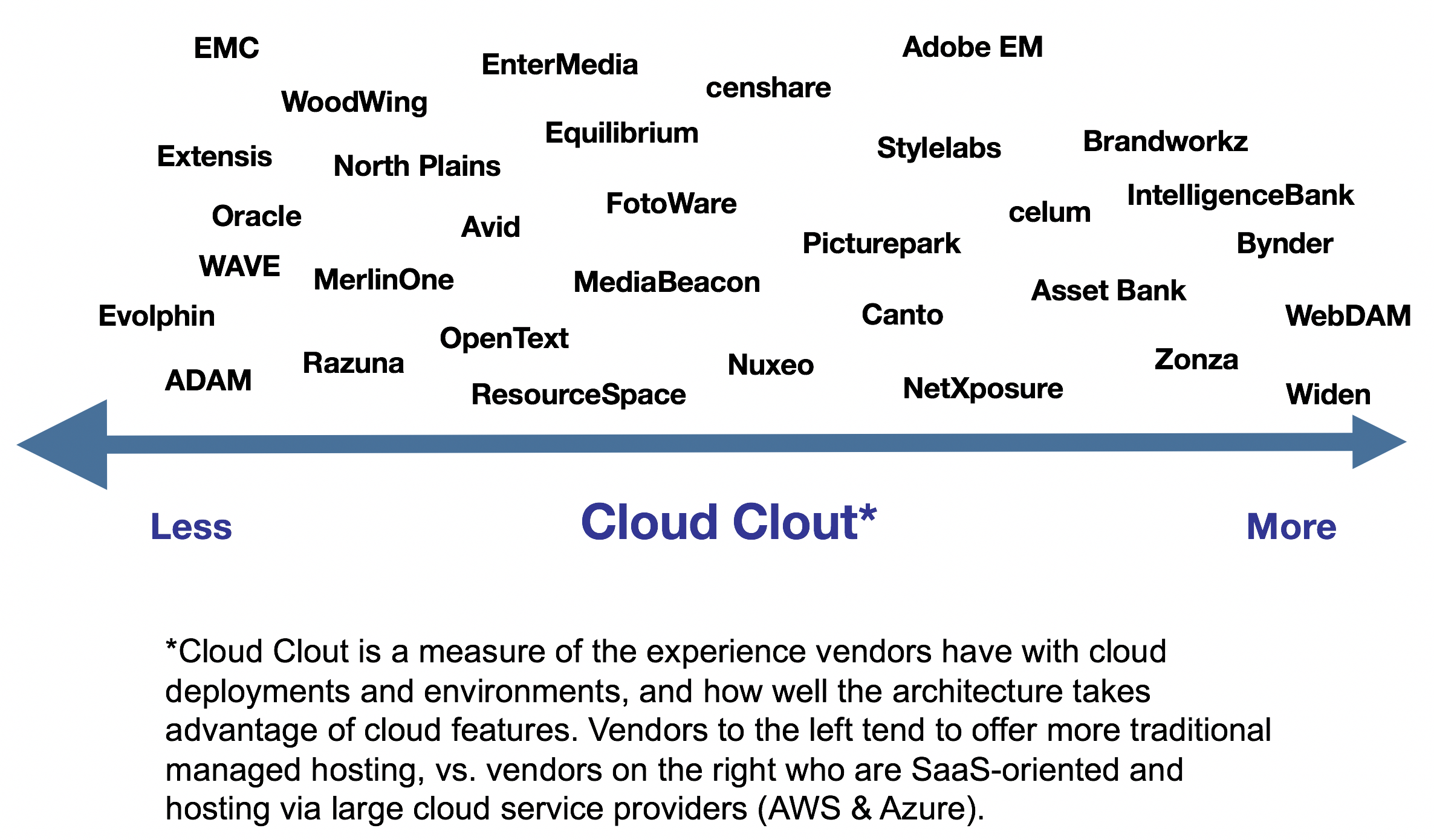

Meanwhile ADAM has been having some issues of its own. Originally a mainstay of the DAM industry in the on-premise era, the company has been slow to embrace the shift to the cloud and move beyond its core use case of multi-lingual brand management.

As we noted earlier, ADAM scores low on RSG's "Cloud Clout" measure and some other rivals have been stealing the march.

Figure: DAM Cloud Clout Assessment, 2017. Source: Real Story Group.

As a then-Google executive wondered when Microsoft bought Nokia: "Do two turkeys make an eagle"? Or will we see the rise of a phoenix here?

What implications for you the technology buyer?

- The good news is that Aprimo and ADAM are not strangers. They have been working together, have some common clients and a product integration (ADAM connector to Aprimo MRM) exists. Joint customers can see some benefits like reduced vendor management overhead.

- European DAM vendors such as ADAM have traditionally struggled with customer support for North America. Chicago-headquartered Aprimo has the potential to alleviate such concerns.

- Both vendors have accumulated technical debt in specific areas that they need to clear off. Consult our research for more detail. Closely track product roadmap progress here.

Overall, there is some rationale to coming together of MRM + DAM toolsets but at RSG we always counsel that you shouldn't purchase two different products just because they come from the same vendor. If you're a research subscriber, don't hesitate to reach out for a private discussion of your options.