Campaign and Lead Management Marketplace - 2017 vs 2016

RSG's recently released Campaign and Lead Management Market Analysis describes the relative positioning of key vendors in this segment using our Reality Check framework. The Reality Check is a snapshot of the market at a point in time and complements the in-depth evaluations in our full Campaign and Lead Management Technology research.

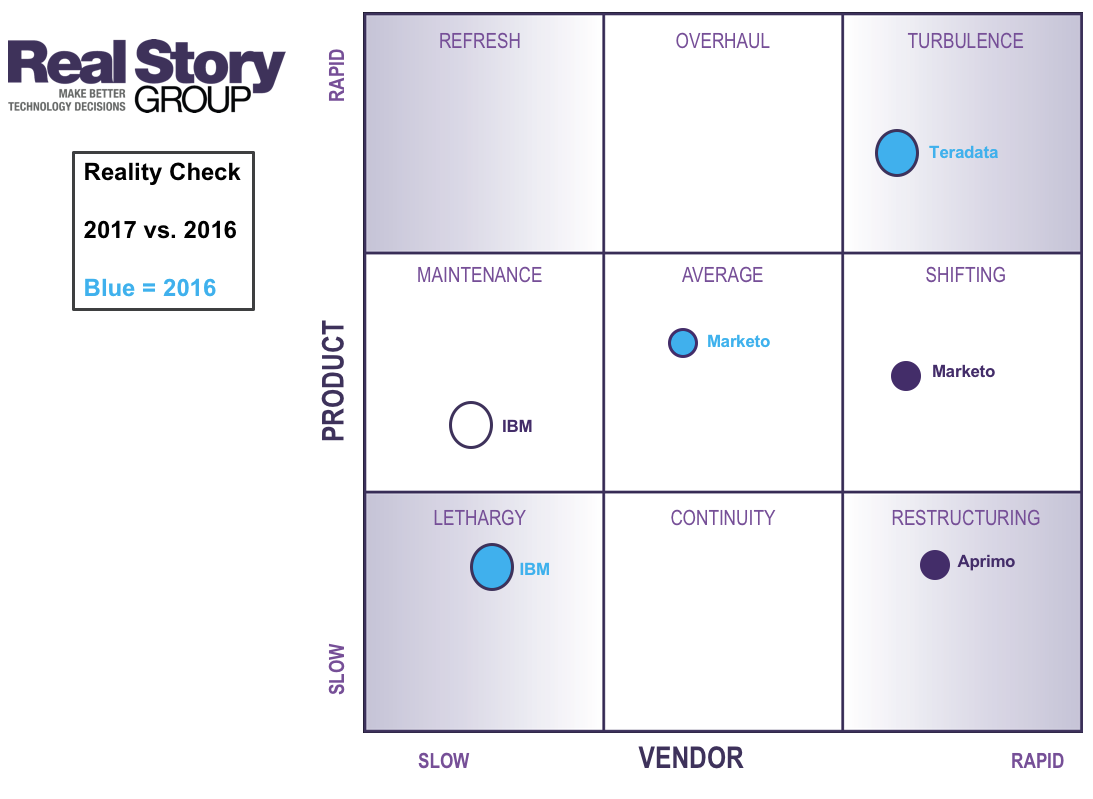

As I noted here, every year we plot vendors along key dimensions, two of which are the pace of product evolution and vendor change. There is no single right place on this chart, but the trajectory a vendor follows has significant implications for technology buyers.

So, it is interesting to plot how the trajectory has changed from last year to this year.

The below shows this change from 2016 to 2017 for three vendors. Note the blue circles indicate the 2016 positions and the purple/white positions are for 2017.

RSG Campaign and Lead Management Reality Check 2017 vs. 2016 - Select Vendors. (click to enlarge)

Let's review a bit:

- Teradata / Aprimo: You'll find that the change has been considerable for Teradata. They sold off the marketing applications division to a private equity company, who reverted to the pre-2010 branding of Aprimo. It's not difficult to imagine how the selection considerations and what areas you'd assess them on would be different now than in the past.

- Marketo: The Marketo trajectory reflects that they went from being a public company to a private one with new owners, and on the product side, they've been re-architecting the platform. Here again, some of the strategic considerations during the selection process would change while some considerations remain the same.

- IBM: The small shift in IBM positioning (Elephants don't dance - they sway in place?) reflects the product updates that we have started seeing after a rather long and sluggish period of post-merger integration phase of acquired MarTech companies.

The larger point here is that as a prospective buyer or existing customer, assess your tolerance and preference for both vendor and technology shifts carefully. There are several trade-offs that you need to evaluate in your own business context.

I've shown only for three vendors here but the 2017 CLM Marketplace Analysis highlights the marketplace shifts for all the vendors we evaluate in the Campaign and Lead Management Technology research. Additional commentary on these dynamics is also available in this on-demand webinar. Just note that both of these are exclusive to RSG subscribers.

Not a subscriber and want to sample RSG's evaluation research first? Sure, try it out here.