Teradata files for divorce from MarTech. What gives?

Teradata, one of the vendors we evaluate in our Marketing Automation and Social Technology research stream, announced that is looking to sell it's Marketing Applications business.

Though known more for its data warehousing software, Teradata has been playing for many years in the marketing technology software segment. According to the company, this retreat from the MarTech space allows it to focus on bread-and-butter data and analytics software.

Teradata's Marketing Cloud

In recent years, Teradata has tried to emulate the acquisitions playbook of MarTech rivals to assemble a marketing cloud of sorts, picking up:

- Aprimo (marketing resource management)

- eCircle (email marketing)

- Ozone (creative agency)

- Argyle (social marketing)

- Appoxee (mobile messaging), and most recently...

- FLXone (data management platform) in Oct 2015

Given these investments, Teradata's move to withdraw from the growing MarTech space may seem a bit surprising at first glance.

Sticking to Its Knitting

However, these Marketing Applications represented less than a tenth of the company's overall revenues. Also, though some products in Teradata's marketing portfolio (e.g., Aprimo) could be considered as being among the leaders in specific categories, the entire platform as a whole did not sizzle, and much integration work lay ahead. This would require ongoing resources and investments. Teradata decided (reasonably so in my opinion) to put its resources to use elsewhere in its core business, which is also in a flux because of cloud-adoption and newer Big Data technologies.

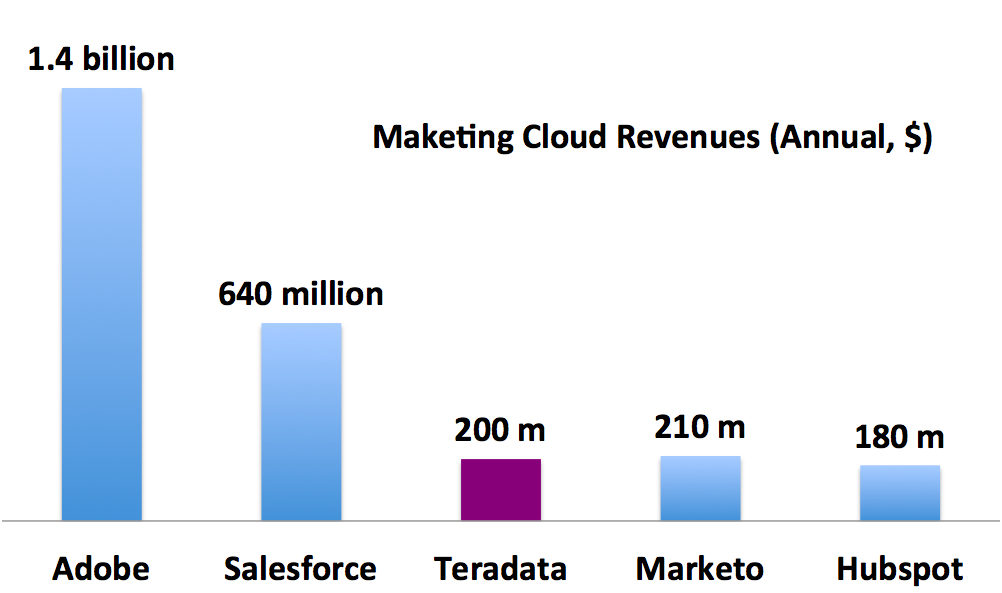

In the MarTech space, Teradata was in a curious position. Compared to the larger players competing for large enterprise business (such as Adobe and Salesforce), Teradata had a major gap to close both with respect to the product offering and the ecosystem around the product. At the other end, SaaS vendors (such as HubSpot and Marketo - both of which have revenues comparable to Teradata Marketing Applications BU) are perceived to be nimbler and are aggressively garnerning business in the medium-sized enterprise segment. As a consequence, rivals were outpacing Teradata in terms of traction and growth

Figure: Marketing Cloud Annual Revenues by Company. Source: RSG estimates and company reports

Their current decision to hang a "for sale" sign on the Marketing Applications business is simply an acknowledgement of this: they were not willing/able to continue the investments needed to break into the big league of end-to-end marketing clouds.

By the way, it was not widely reported at the time, but in June 2015 Teradata took a loss and wrote down $340 million associated with its marketing applications acquisitions -- a signal that their MarTech business was not doing as well as hoped for.

What are the implications for you as a customer?

How this impacts you the enterprise buyer depends on who ends up buying Teradata's MarTech business. If you are a current customer, expect some near-term uncertainty as the sales process gets underway and the new owners take charge.

If you are currently in the market for MarTech software, you don't have to necessarily exclude Teradata's toolset from your selection shortlist, but until at least the dust settles down, always remember that you have many alternatives.