Reading the M&A Tea Leaves - Social collaboration going mainstream

There has been a steady stream of M&A activity in the Enterprise 2.0 software space. While a few deals like Microsoft’s acquisition of Yammer get a lot of attention and spur discussions, there are also many other smaller deals that don’t get a lot of attention beyond the tech blogosphere. But these deals can signal to us what’s down the road in interesting ways.

Take the acquisition of social collaboration software vendor Qontext by Autodesk. Autodesk is best known for its CAD software, and this acquisition is an effort to add more ways for project teams to collaborate around its engineering design facilities.

Social networking has found its way in many other types of enterprise software. VMWare’s Socialcast acquisition was intended to bring E2.0 capabilities to the various VMWare tools used by IT teams. Similar motives were behind Citrix acquistion of Podio. Salesforce.com acquired Rypple to add social capabilities to the talent management function. The list goes on and on.

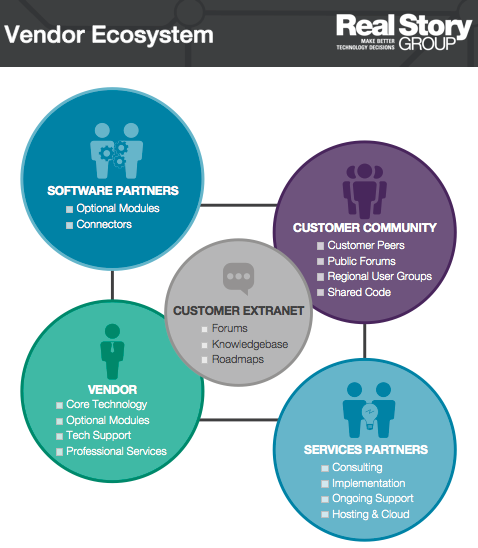

Meanwhile, other large vendors like IBM, Oracle, SAP, and Tibco have released and/or updated their social software offerings and are trying to socialize legacy applications and business processes. Sure, their approaches may differ, dictated in part by their legacies in the enterprise software market.

If you step back and look at the big picture behind all the market activity, to me it looks like enterprise social software has indeed come a long way and is fast becoming mainstream, and a regular feature within different enterprise software categories.

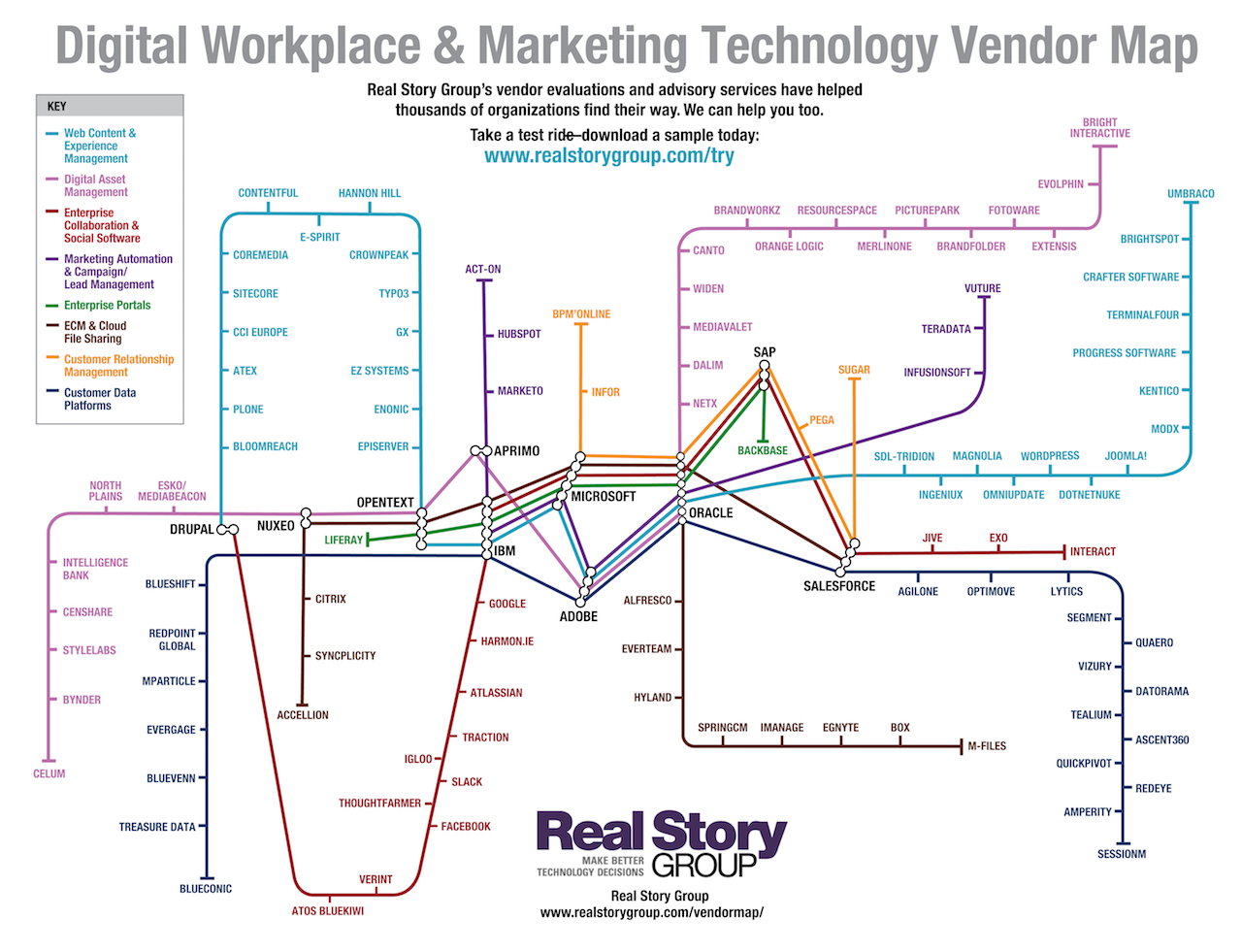

As you head into 2013, its high time for you as an enterprise customer to mull your own plans for leveraging social software. The challenge, of course, is that now almost every major software vendor has some sort of answer for you. Here’s a handy reference to help you in your journey.