The Web Content and Experience Management Marketplace in 2012

The Web Content & Experience Management marketplace remains highly fragmented, although it has seen more M&A activity in the past year. Given the plethora of vendor choices, prospective WCXM customers should take a multidimensional approach to identify the best fit for their individual situation.

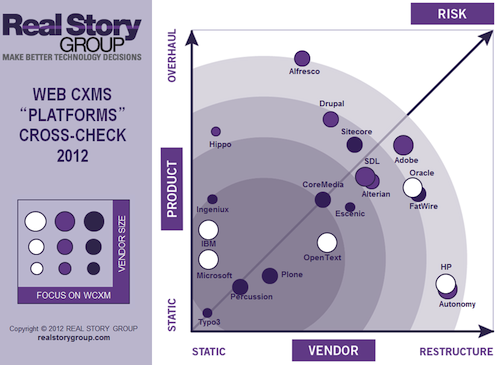

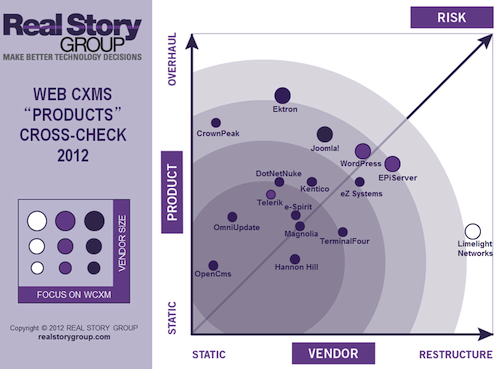

Yesterday we published an updated "Cross Check" marketplace analysis, which identifies potential problems and opportunities for all of the WCXM vendors we evaluate. The two charts below are republished from that briefing.

Rise of the Planet of the Platforms

We've found it useful to organize vendors primarily according to complexity and power. Specifically, we make a distinction between "platforms" and "products." See this advisory briefing for more background on this division.

If there is one overall trend we see right now, it's the growing "platformization" of WCXM systems. Some organic customers forces are driving this, including greater centralization of (more CMS-savvy) web teams, along with greater website complexity more generally. But vendors, too, are pushing harder to go upmarket, filling a vacuum left by the many fading players in this space. (For a deeper critique of each major vendor, consult the individual product chapters in our full WCXM evaluation research.)

About Cross Checks

These charts represent four key dimensions -- Vendor Size, Focus on WCXM, Vendor Evolution, and Product Development -- that supplement functional and cost analyses in any major procurement decision. In committing to a purchase, you are also committing to a short-term implementation — and a long-term relationship. There are always risks in both timeframes.

As always there's no "right" or "magic" or "leader" location. Buyers with strong internal IT processes and a predilection for early adoption may favor a vendor undertaking fundamental changes, on the grounds that they may be able to influence roadmaps and new technology, as well as "leapfrog" competitors that are stuck with older tools and approaches. Other customers may prefer a WCM supplier evolving at a more moderate pace, while still others prefer a very conservative approach.

Each of you will rate the importance of these dimensions differently and we encourage you to make use of these visualizations in the broader context of other considerations in your selection process.

Platform-oriented WCXM Vendors

Fig 1. RSG Cross-Check for Platform-oriented WCXM Vendors

Download larger image

-----

Product-oriented WCM Vendors

Fig 2. RSG Cross-Check for Product-oriented WCXM Vendors

Download larger image

To understand why we placed particular vendors in specific places on the chart, Web CMS research subscribers can download our 8-page background briefing.