Beware big vendors if you care about viability

News of Big Blue's sudden ejection of its entire MarTech portfolio reversed an old adage: it turns out IBM can fire you.

This past week reminded me of events early in my career as a tech industry analyst. When I was a pup in this business, I noticed that some of the best solutions came from smaller vendors. Upon hearing this, my elders would pull me aside and say, "sure, but how much longer will that vendor be around?"

The Myth of Large-Vendor Stability

In the wake of the dot-com bust, the old canard, "no one ever got fired for recommending IBM" got replaced with, "at least we know IBM isn't going away any time soon."

That's always proven a hard argument to counter, because of course everyone harbors fears about their vendors' viability. Statistically, many small businesses fail. Software vendors are no different, and who wants to get stuck with an unsupported product?

Two decades and much gray hair later, I've come to the conclusion that the very biggest vendors can actually carry the highest risks in terms of product continuity. IBM, Microsoft, Oracle, Adobe, Google, and Salesforce aren't going to fail as companies, but they will kill individual products at the drop of the hat. Remember they are constantly buying other vendors and selling off pieces of their portfolios, while their own product strategies can shift quickly, due to staff turnover, equity market shifts, or simple faddishness, to which the biggest players are equally susceptible.

When IBM Fires You

And so today's news that IBM is selling off practically the rest of its digital engagement portfolio — Big Blue's entire Marketing/Ecommerce stack, after selling off most of its Digital Workplace stack to HCL earlier this year — will likely prove a bitter pill for customers who thought IBM would at least bring longterm stability in a somewhat turbulent MarTech marketplace.

As usual the new owner (an investment fund) will promise innovation and roadmaps, but with some exceptions like the Watson Content Hub, this set of IBM tools carries a lot of technical debt. My hunch is that the acquisition represents fundamentally a financial exercise, as the new owners play out the string with platforms that, if nothing else, can boast substantial customer lock-in and years of lucrative maintenance revenue streams. For you the customer: I'm sorry.

Sure, IBM is not alone. I could cite similar examples from all the other big vendors mentioned above. Microsoft, Google, Salesforce, and even Adobe in early days have all killed Web CMS platforms, sometimes abruptly.

What About Small Vendors?

Smaller vendors, especially those focused on one platform, are staking their corporate lives on their offering. Their product could still weaken over time — and as a customer you need to stay on top of innovation and support levels — or the vendor could shift its roadmap significantly, with negative consequences for you. But you much rarely see a capricious decision to discontinue it outright.

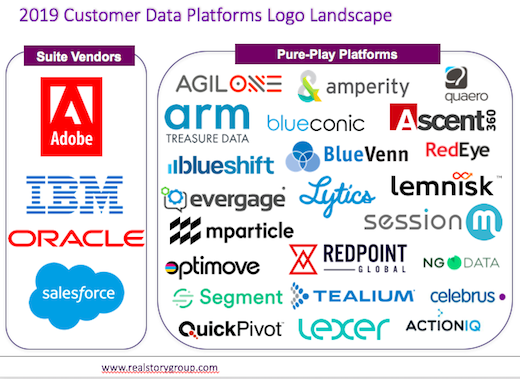

Today, many people raise concerns about the generally smaller vendors in the highly-fragmented CDP marketplace. I understand those concerns, but that shouldn't have you defaulting to solutions from, say, Salesforce and Adobe.

CDP Marketplace circa H2/2019 is still dominated by pure-play vendors as the big suites struggle to catch up. Source: Real Story Group

Could your small, focused vendor go kaput? Sure. Can open source projects wither? Absolutely. It's always possible. I've learned to look at viability and continuity as a multi-dimensional challenge, and our evaluation research for each of the 150 solutions we cover analyzes the challenge from several perspectives, to give you the broadest possible picture of your risks.

In the end, though, if stability is a high priority, the biggest vendors may not present your best choice.