Is Google finally serious about the enterprise segment?

Disdainful neglect. That's how I'd describe Google’s attitude towards the enterprise software segment.

To be sure, there were forays into the enterprise such as Google Search Appliance and Google Apps (most notably Gmail), as well as several shiny consumer-tech hand-me-downs. But the strategy came across at best as tentative and there was a question mark hanging over the seriousness of Google’s enterprise ambitions.

In recent years and particularly in the past few quarters, Google is giving off signals that it wants to take another run at the enterprise arena. Let's look at what’s causing this change.

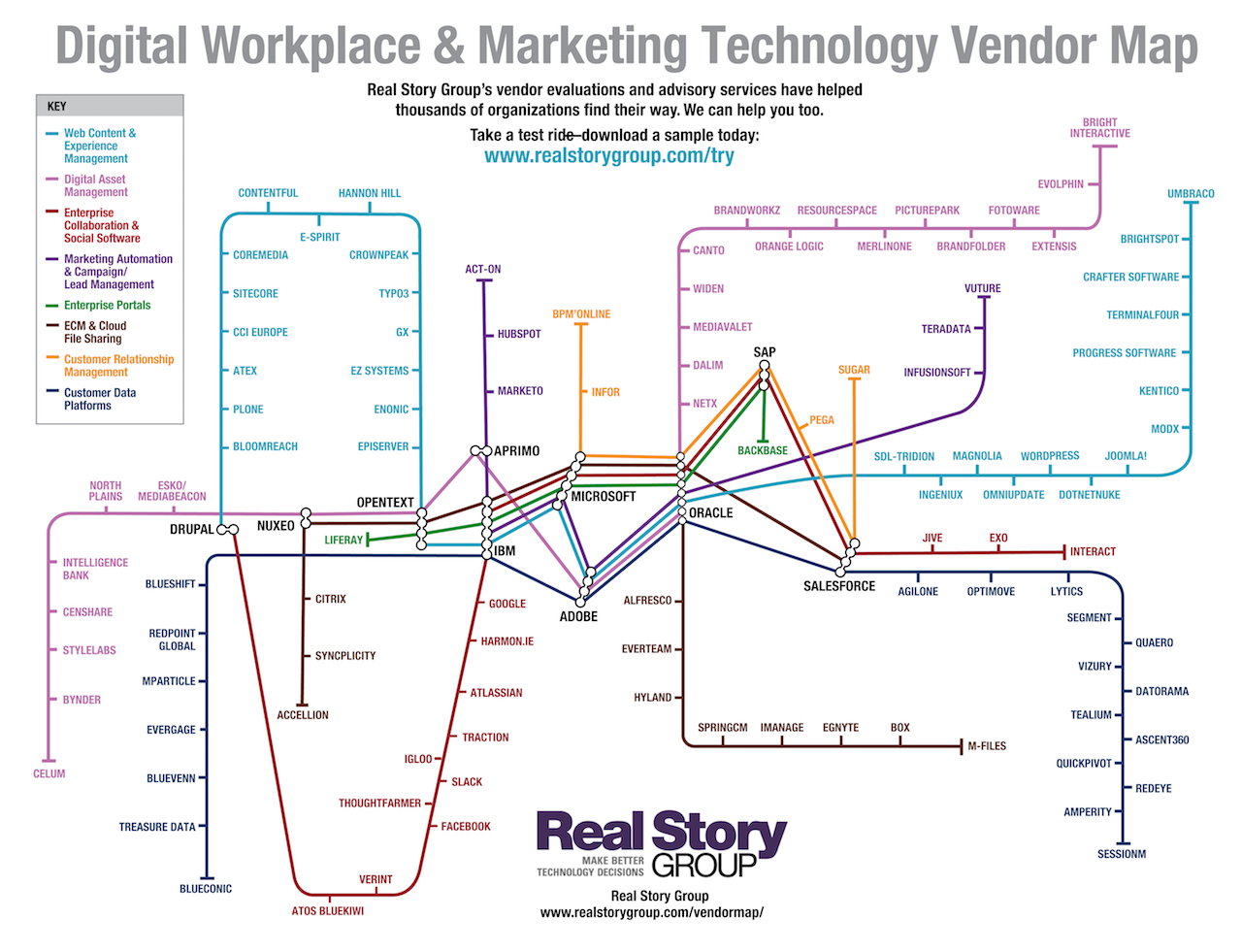

Consumer technology companies smell opportunity in the enterprise and cloud

Firstly, Google is not alone here. As growth saturates in core consumer businesses, tech companies are increasingly turning to the enterprise segment. Apple wants to develop business apps with IBM and SAP; Facebook is testing the waters with Facebook @ Work, and then there's Amazon, which took the world of cloud computing by storm. With the rise of cloud, the enterprise segment is not necessarily a side show but can be the next growth frontier even for these behemoths with billions of dollars in revenue.

Next, there's Google's reorganization. The crux: Alphabet as a holding company with several bets placed in various stages of maturity. In this set-up, the founders can focus on "moonshots" (e.g., driverless cars) while Google itself has the bandwidth for pursuing opportunities in the enterprise segment, once considered too mundane.

Google Enterprise Offerings: Cloud and Apps for Work

The two main Google enterprise offerings are Google Cloud and Google Apps, the productivity/collaboration suite of solutions evaluated in our research.

To lead the cloud business, Google has hired the ex-CEO of VMWare and announced investments in infrastructure and applications, but it faces established rivals with aggressive plans of their own: Amazon, Microsoft and IBM. For a long while, Google adopted a “public-cloud only” stance, but now (if a bit grudgingly) will support hybrid cloud models – acknowledging enterprise ground realities. Success requires demonstrating flexibility and embracing enterprise requirements, not just on technology chops.

The second arrow in Google’s enterprise quiver is Google Apps for Work (subscribers can read our candid review). Google Apps is primarily a collection of collaboration (email, file sharing, calendar) and productivity (Google Docs) tools. Here Google competes with Microsoft's Office 365 head on.

Advice for Potential Google Apps Customers

A savvy customer will look beyond the brand name and carefully assess functional depth. When it comes to other collaboration applications of the sort an IBM Connections or a Jive offers, Google's cupboard comes off as pretty bare. You can still turn to Google Sites but it's not as mature as rival offerings.

When evaluating Google for Apps, keep this mind: when Google says they are one of the largest vendors of collaboration software, it is not an apples-to-apples comparison. They have Gmail in mind while you are probably thinking different collaboration applications.

In this space, Google – and therefore its customers – face several challenges on both the product and organizational fronts. On the product, in theory several tools exist. But there is day and night between using Google+ for social networking services vs. a more mature product like a Yammer or an IBM Connections. Same story with Google Hangouts versus say a product like Webex / Skype. Of course, Google pricing is very aggressive and it represents an undeniable value at the price for certain types of customers. Just make sure that it is indeed what you want.

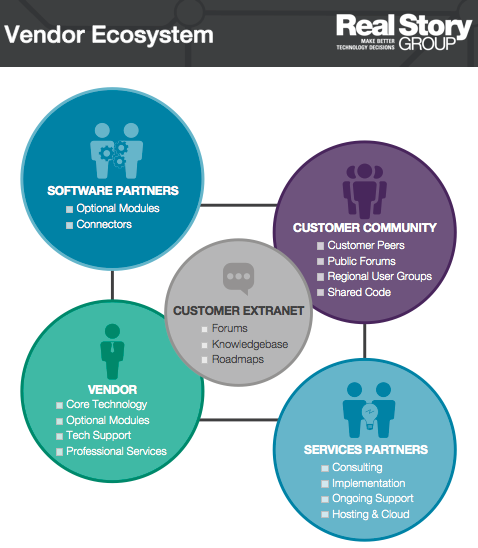

Google has not had a stellar reputation for customer support around Apps. But that may be changing as Google is more consciously building out the channel and partner ecosystem. To be sure, Google understands these and other challenges. For instance, the recent tuck-in acquisition of Synergyse, a small company that trains customers on how to use Google Apps, is perhaps their first-ever acquisition for customer training – a key enterprise concern – indicating that Google is beginning to bend more to customer expectations.

As a potential customer, understand that Google is signaling serious intent but that they are still in the early stages of that journey. Today, Google remains a dark horse in the enterprise segment and this marketplace offers a lot of choice.