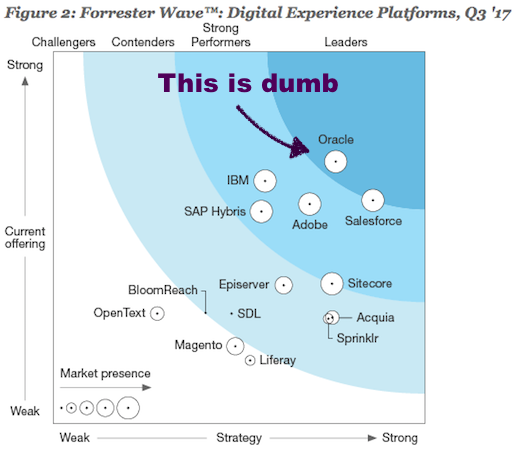

The deeper meaning behind Oracle's rejection of social media

All companies have personalities. Software companies tend to have strong personalities, typically imprinted by a type-A founder.

No firm illustrates this more than Oracle. When it acquires other companies, they get Oraclized -- or rejected.

Oracle Fires Its Social Media Evangelist

A recent article in the San Francisco Chronicle detailed how Oracle's big strong body rejected a recent graft in the form of social media guru Jill Rowley, who came over when Oracle acquired a nimble digital marketing vendor called Eloqua. (Credit Susan Scrupski for forwarding the piece.)

The article's punch line is that Oracle "doesn't get social." For the digerati, there is no worse affliction. It's like hating kittens. For enterprise technology customers, however, there are deeper lessons to learn.

There's a Deeper Problem Here

Leave social media aside for a moment. This vendor faces a much larger challenge. Oracle brings complex software platforms to market with an intensely hard sell, in a world that wants simpler solutions and more agile partnerships with suppliers.

At least one Oracle leader recognizes the problem. From the Chronicle piece:

"Oracle president and former Hewlett-Packard CEO Mark Hurd wants to transform Oracle's cutthroat sales force into a faster-moving, imaginative group that's focused more on long-term customer relationships than closing a sale."

Nice plan, but....good luck with that. Oracle's approach goes way beyond pushy salespeople. Have you ever seen an Oracle contract? Any normal person reading one could come to the conclusion that this vendor might actually dislike you.

OK, Oracle is not as a bad as Autonomy back in its pre-HP days, but Oracle would still join most insider lists of top-three most customer-unfriendly vendors. Any social media guru that Oracle employs is simply going to expose this, unless the company's fundamental culture changes.

All the more a pity, by the way, since a segment of Oracle's software is pretty good, and a smaller slice of that is very good.

From Products to Services

In a similar vein, this episode bodes poorly for Eloqua and other digital marketing vendors that Oracle has acquired. They live in a very different world, characterized by smaller deals inked after pragmatic customer testing, rather than sealed over schmoozing with your VPs on the 18th green.

Remember also that many of these acquired platforms are SaaS-based. They provide a service, not a product. As a customer, you should never forget that it takes very different vendor skills and approach to support delivering technology as a service. As one customer explained to my colleague Apoorv, "Oracle still thinks customer service means bug fixing."

Can Big Vendors Really Change?

There's ample evidence that larger software vendors beyond Oracle are struggling with this transition. Microsoft's Office 365 has not yet completely crossed the chasm for larger enterprises. IBM has struggled to put its core software into the cloud and has tended to rely on simple managed hosting of traditional technology, sometimes via partners.

For any of these larger vendors to succeed at rent-and-service rather than sell-and-support, they're going to have to change their organizational culture and operational structures. Oracle more than most. Can they get there in a reasonable timeframe? I have doubts.

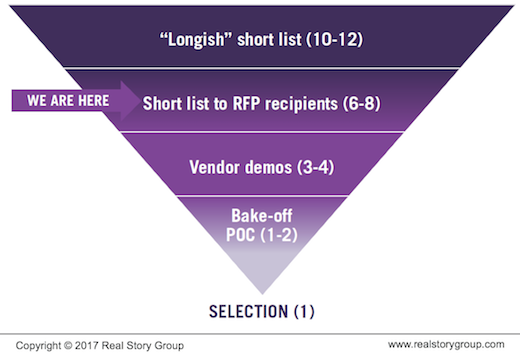

As always, you should test the supplier as much as you test the technology. For a deeper look at such vendor intangibles on a case-by-case basis, consult any of our evaluation research.